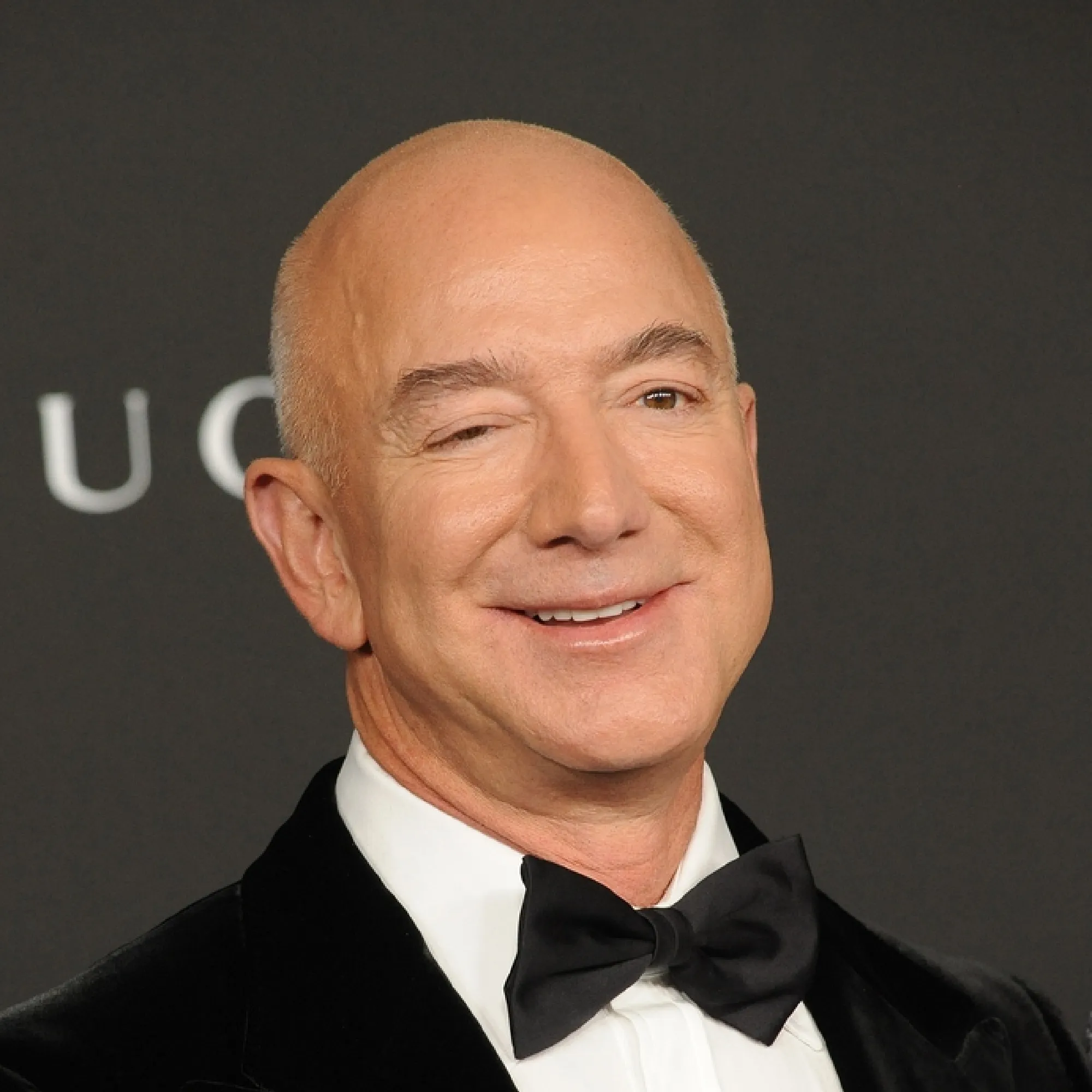

ProPublica Report Reveals Jeff Bezos and Billionaires Paid Minimal Federal Income Tax

| Political | Economic Downturn |

Updated By: History Editorial Network (HEN)

Published:

4 min read

A report by ProPublica exposed that Jeff Bezos, along with other prominent billionaires, paid minimal to no federal income tax for several years while their wealth significantly increased. Utilizing IRS data, the investigation highlighted stark disparities between the tax obligations of ordinary Americans and the extremely wealthy. Despite considerable growth in their asset values, individuals such as Bezos managed to navigate the tax system to minimize their taxable income legally.

For instance, ProPublica revealed that in certain years, Bezos paid no federal income tax after deducting substantial investment losses and leveraging other legal tax strategies. This situation arose amidst a broader discourse on economic inequality and sparked debates on the fairness and efficiency of the U.S. tax code. Many argue that such practices, although legal, undermine the tax system's integrity by allowing the wealthiest to contribute a proportionally smaller share of their income to public revenues compared to average citizens.

The disclosures brought renewed attention to proposals for tax reforms, including the implementation of a wealth tax or changes to capital gains taxation. Proponents suggest that reforming the tax code could address the concentration of wealth and fund essential public services. Critics, however, caution that abrupt changes could have unintended economic consequences.

This revelation had significant implications for the public's perception of the ultra-rich and their contributions to society. It called into question the effectiveness of existing tax policies in ensuring equitable financial responsibility and funded public infrastructure and services.

#TaxJustice #WealthInequality #EconomicReform #MoofLife

Primary Reference: The Secret IRS Files: Trove of Never-Before-Seen Records Reveal ...

Explore the Life Moments of Jeff Bezos |